SBI Clerk positions remain some of the most desirable roles to pursue in the banking industry owing to the good reputation and the sheer size of the organization, State Bank of India. SBI has formulated the salary framework for SBI Clerks in a way that meets industry standards and assists in attracting as well retaining valuable talent with the organization. Salary structure is important for aspirants because it reveals the monetary benefits and career advancement opportunities that come with the job.

The salary structure of the SBI Clerk includes several important constituents: the monthly basic salary, DA, quarterly house rent, and monthly transport and special bonuses. Each factor is imperative in shaping the total salary and therefore can not be neglected. The basic pay serves as the benchmark as well as the foundational pay element that each of the other components, such as allowances, is calculated upon. Such a structure is bound to enhance employee satisfaction since the compensation is balanced, receiving a commensurate package, which includes an assortment of compensation that surpasses basic salary.

Apart from the basic pay and SBI Clerk’s salaries, they also receive additional perks such as medical, retirement funds, pensions, and other awards for the SBI Clerks’ incentive-based performance evaluations. These perks greatly improve the entire pay package, further augmenting the appeal the position holds. Here, we will discuss the individual features of the pay increments and other details so as to paint the entire picture of how rewarding a career as an SBI Clerk can be both financially and from a professional standpoint.

Salary raise SBI clerks will get the in the year 2025.

For aspiring SBI clerks and current ones, the news for the year 2025 is in the form of an announcement that the State Bank of India has decided to increase the pay package significantly. This is a clear indication of the dedication that the bank has maintained of its services when it comes to the wellbeing of its employees. The new structure sets a maximum earning potential for an SBI Clerk of Rs. 45,888, a clear increase from the estimated earning potential calculated previously.

This pay rise is aimed at helping SBI compete in retaining the best talent in the banking industry. SBI hopes to improve the morale of its employees by ensuring that they are paid enough for the effort they put in. This rise also reflects the value that the bank recognizes in its operations, especially in the clerical level. SBI hopes to improve the morale and job satisfaction levels of employees.

Based on the expectations, the salary increase should enhance retention and recruitment of employees. In general, overhead expenses lead to an increase in job satisfaction, and in turn, a decrease in the rate of staff retention. For job applicants, the marked increase in salary makes the job of SBI Clerk much more attractive with a high potential for earning. In this article, we will analyze the elements of the new salary structure and then compare it with the salaries of some other banks to highlight the key benefits.

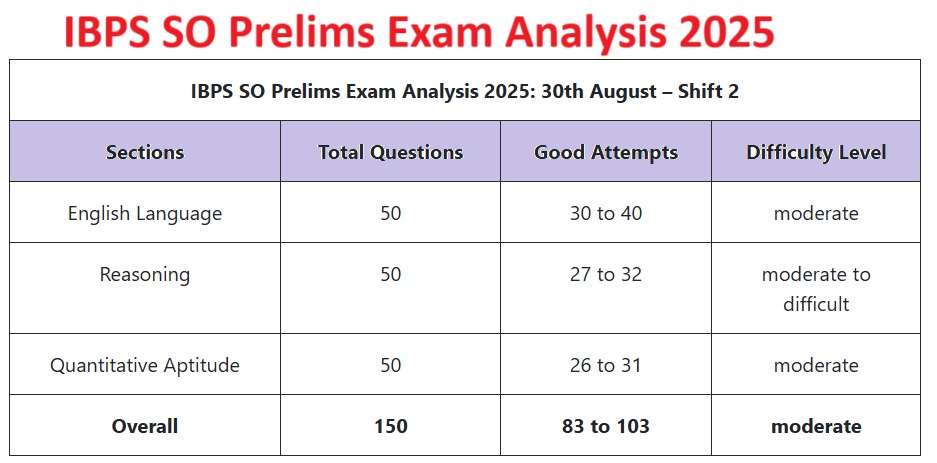

IBPS SO Prelims Exam Analysis 2025 – 30th August

This analysis covers both Shift 1 and Shift 2 of the IBPS SO Prelims exam held on 30th August 2025. Candidates can check the good attempts, difficulty level, and section-wise question breakup to evaluate their performance.

Exam Sequence: English → Reasoning → Quantitative Aptitude

Shift 2 – 30th August 2025

Overall Good Attempts and Difficulty

| Section | Total Questions | Good Attempts | Difficulty Level |

|---|---|---|---|

| English Language | 50 | 30 – 40 | Moderate |

| Reasoning Ability | 50 | 27 – 32 | Moderate to Difficult |

| Quantitative Aptitude | 50 | 26 – 31 | Moderate |

| Overall | 150 | 83 – 103 | Moderate |

Quantitative Aptitude – Shift 2

| Topic | No. of Questions |

|---|---|

| Caselet DI | 5 |

| Pie Chart DI (students) | 6 |

| Bar Graph DI (boys & girls) | 6 |

| Table-based DI (sports & arts) | 6 |

| Approximation | 6 |

| Quadratic Equations | 6 |

| Arithmetic Problems | 15 |

| Total | 50 |

Reasoning Ability – Shift 2

| Topic | No. of Questions |

|---|---|

| Parallel row seating (14 persons) | 5 |

| Circle seating (8 persons, inside, double variable) | 5 |

| Floor puzzle (8 floors) | 5 |

| Linear seating (8 persons, double variable) | 5 |

| Order & ranking puzzle | 3 |

| Data sufficiency | 3 |

| Input-output | 5 |

| Direction | 3 |

| Syllogism | 3 |

| Blood relation | 4 |

| Inequality | 3 |

| Critical reasoning | 3 |

| Miscellaneous (alphabet, number, meaningful word) | 3 |

| Total | 50 |

English Language – Shift 2

| Topic | No. of Questions |

|---|---|

| Reading Comprehension Set 1 (AI in USA) | 9 |

| Reading Comprehension Set 2 (BPO industry in Africa) | 9 |

| Para jumble | 5 |

| Error spotting | 4 |

| Miscellaneous | 6 |

| Word swap | 6 |

| Connectors | 2 |

| Double fillers | 7 |

| Match the column | 2 |

| Total | 50 |

Shift 1 – 30th August 2025

Overall Good Attempts and Difficulty

| Section | Total Questions | Good Attempts | Difficulty Level |

|---|---|---|---|

| English Language | 50 | 35 – 45 | Easy to Moderate |

| Reasoning Ability | 50 | 25 – 30 | Moderate to Difficult |

| Quantitative Aptitude | 50 | 20 – 25 | Moderate to Difficult |

| Overall | 150 | 80 – 100 | Moderate |

Quantitative Aptitude – Shift 1

| Topic | No. of Questions |

|---|---|

| Table DI (condition-based) | 6 |

| Double Pie DI (rings & bracelets) | 6 |

| Line Graph DI (multiples of 6) | 6 |

| Caselet DI (Zomato & Swiggy orders) | 6 |

| Approximation | 6 |

| Data sufficiency | 3 |

| Wrong number series | 6 |

| Arithmetic Problems | 11 |

| Total | 50 |

Reasoning Ability – Shift 1

| Topic | No. of Questions |

|---|---|

| Square seating arrangement (double variable) | 5 |

| Circle seating (single variable) | 5 |

| Box puzzle (double variable) | 5 |

| Sequence puzzle (2 variable) | 5 |

| Condition-based puzzle | 5 |

| Data sufficiency | 3 |

| Inequality | 3 |

| Direction | 3 |

| Input-output (word & number) | 5 |

| Blood relation | 3 |

| Critical reasoning | 6 |

| Miscellaneous (number & alphabet-based) | 2 |

| Total | 50 |

English Language – Shift 1

| Topic | No. of Questions |

|---|---|

| Reading Comprehension 1 (Country X – banned game) | 8 |

| Reading Comprehension 2 (Microorganisms) | 8 |

| Synonym: Hit | – |

| Cloze Test | 6 |

| Error spotting | 6 |

| Starters & Connectors | 2 |

| Word Swap | 6 |

| Word usage | 2 |

| Sentence rearrangement | 6 |

| Phrasal replacement | 5 |

| Total | 50 |

SBI Clerk Salary Components Breakdown

Let us focus on the new SBI Clerk salary structure by dividing it into its relevant components. The SBI Clerk’s entry-level salary is pegged at Rs. 19,900. This amount marks the SBI clerk’s basic pay. This amount will also increase with time due to the SBI clerk’s expenses and the number of SBI clerk’s years with SBI.

Ty the year 2025, SBI will surely pay SB Clerk more due to position they hold. As of 2023, SBI is paying jaw dropping amounts of DA as it is. The amount SBI is paying out is ensuring that employees can live in the current ecosystem where everything is increasing in price. The way the DA is calculated is also as a certain percentage of the basic pay.

Other significant elements of the wage structure include House Rent Allowance (HRA) which is paid depending on the location of the posting. Employees located in metropolitan cities receive higher allowances as compared to employees located at smaller towns and rural areas. Also, the Transport Allowance pays for the necessary commuting to work and subsidizes the cost of traveling to work for special payments which include the City Compensatory Allowance (CCA) and medical allowances. All these components ensure SBI Clerks receive the wages not only serving the clerical needs but also aiding the SBI clerks in meeting their financial demands and lifestyle.

SBI Clerk and Other Banking Job Comparison

The salary structure of different incremental career levels in banking is an area of concern for most candidates. The SBI Clerk salary is an remarkable magnated when juxtaposed with parallel position in other public and private sector banks. This example not only provides the economic perspective but also reflects the social impact of working with a reputed institution, the State Bank of India.

In public sector banks, the salary scales for clerical positions are more or less uniform, but SBI tends to pay more and provide greater benefits and allowances. For example, SBI provides additional allowances and benefits, often resulting in higher overall compensation compared to other public sector banks. Also, the reputation and the stability offered by SBI adds to the attractiveness of the position.

On the other hand, Private sector banks pay high salaries, but these positions often come with greater performance expectations, shrinking job security, and greater employment risks. While the initial pay might be similar, other long-term benefits like pension, provident fund, and job security are better in public sector banks like SBI. Moreover, career advancement opportunities and the internal promotion policies at SBI are aimed at rewarding loyalty and performance, which makes it a more stable and rewarding career choice.

SBI Clerk Salary and Benefits

Apart from the staggering pay, SBI Clerks receive various additional benefits and allowances which augment the salary they receive. This allowance can help in securing the finances as well as assist in the well-being of the employee along with a proper work life balance. The benefits and allowances attached to this job can help in having a better understanding of the role.

Among the allowances, one of the most compelling is the SBI employees’ medical benefits scheme. This covers not only the employees, but also his/her dependants, which is a huge motivating factor. The policy covers the employees’ and dependants’ outpatient consultations, hospitalization, regular family health check-ups, and quality health care services which ensures comprehensive employee wellness. Moreover, SBI Clerks are eligible for leave travel concession (LTC) which enable them and their family to travel with them at subsidized charges, hence promoting family bonding.

SBI has an additional pension plan and provident fund benefit schemes, which ensures financial stability and aid saving after one retires. Performance-linked bonuses and other incentives also add to the strong appeal these banks have, as these schemes pay off for the effort, time, and other resources invested. It also serves the purpose of enhancing financial stability and serves as a motivation for the respective employees to work towards the respective goals. Other benefits such as housing loans, and education for children at reduced fees also add to the attractive compensation package these banks have.

Implications of Salary Changes on Employee Satisfaction

With the enhancement of the salary for SBI Clerks, it has a potential to increase the level of job satisfaction and the morale of the employees. Due to the operational nature of work, an increase of salary leads to a more stable financial balance, which greatly decreases the employees level of stress. When employees are receiving a proper amount of remuneration for the amount of work being done, it will increase employee drive and satisfaction drastically.

An employee’s perception connected with fairness and recognition directly affect their job satisfaction. With SBI’s recent salary hike, the institution acknowledges the clerks hard work and contributions. Such recognition can contribute to improved morale, fostering a environment where employees feel appreciated. Such a workforce characterized with satisfaction leads to a dip in the turnover rate as employees become more productive, loyal, and less inclined to look for jobs with different employers.

Meeting financial obligations becomes less strenuous with the newly added salary and benefits, allowing employees to even focus on personal goals. This newfound personal well-being can lead to motivation that translates to the workplace. SBI appears to strategically position itself to enhance the perception of existing employees, in addition to bolstering efforts to attract new talent, increasing employee satisfaction and loyalty.

Opportunities for Advancement in Career for SBI Clerks

SBI Clerk comes with a unique combination of challenges ‘n’ an appealing salary alongside numerous benefits. SBI also provides ample advancement opportunities, with a full-fledged career growth structure. This position is most ideal for an ambitious professional due to the unmatched career growth potential.

Progression for SBI Clerks includes advancement to Junior Associate, Senior Associate, and Officer level positions through the internal promotion ladder. With each advancement, the attendant perks of each position also increase. SBI routinely conducts promotional exams and trains employees tailored for these roles, making it easier for willing participants. Employees who are willing to invest in their career progression are rewarded with escalating responsibilities, alongside salary and benefits commensurate to the new position.

In addition, the employees are greatly helped by the bank’s policy of continuous education and skill acquisition. SBI provides ample training, workshops, and e-learning for employees, ensuring they are hyper-knowledgeable and adept in diverse fields. This philosophy of nurturing their employees goes a long way in promoting the growth of the organization as a whole. SBI is ideal for those willing to invest in their banking career with unparalleled promotional prospects.

How to Prepare for SBI Clerk Recruitment

An SBI Clerk position demands one to be well prepared and take a structured approach to the recruitment process. A recruitment process for an SBI Clerk involves a preliminary examination, a main examination, and a language proficiency examination for the SBI Clerk position. Each stage assesses different skill sets and knowledge areas, therefore it is important for candidates to be fully prepared for every stage.

The preliminary examination is made up of English Language, Numeral Ability, and Reasoning Ability sections. Candidates for this position must gain proficiency in the area. Regular practice of mock tests and question papers of previous years is essential to gain familiarity with the pattern and learn to manage time. A visit to an SBI Clerk exam online coaching site or a marketing SBI Clerk exam coaching classroom will greatly improve candidates’ skills in expert guidance and coaching tips.

The main examination is further divided into different subject areas such as General/Financial Awareness, General English, Quantitative Aptitude, Reasoning Ability & Computer Aptitude. They must be up to date with current affairs, especially in the banking and financial worlds. In this stage, the candidate is most likely to perform well with the aid of a study timetable, addressing gaps, and regular revision. Preparing for the language proficiency interview, which is conducted in the candidate’s local language, is also critical for the final selection. With this level of competition, diligent preparers cannot miss the targeted plan for the construction to successfully navigate the recruitment process to be a prospective SBI Clerk.

Salary of SBI clerk frequently asked questions

Base pay for an SBI clerk 2025 is 19900. That is the basic pay and is the first step in the entire pay process. Basic pay remains unchanged, and various allowances and benefits provided to the employees, make the SBI clerk total pay more attractive.

An SBI Clerk can earn a maximum of Rs. 45,888. This amount comprises of basic pay, dearness allowance (DA), house rent allowance (HRA), transport allowance (TA), and other special allowances. This amount also varies based on the city of posting and other factors.