The SBI Clerk post is a very sought-after job in the banking industry by numerous aspirants since it belongs to a quite reputed organization and offers handsome pay. Here in this write-up, we are going to discuss the detailed salary structure for the post of clerk in hand salary slip allowances pertaining duties as well as future prospects. The article will also throw light on revised pay after training period conditions of work.

SBI Clerk Salary 2025 Starting Pay and In-Hand Salary

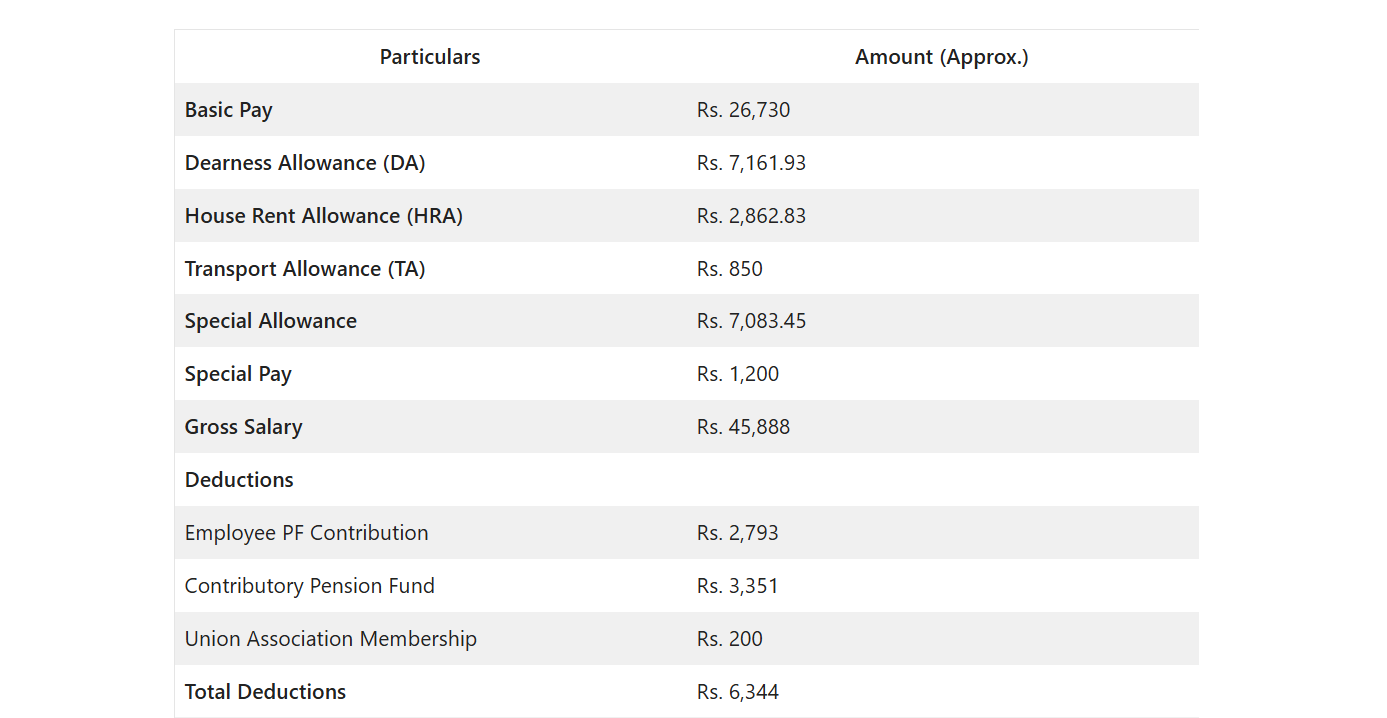

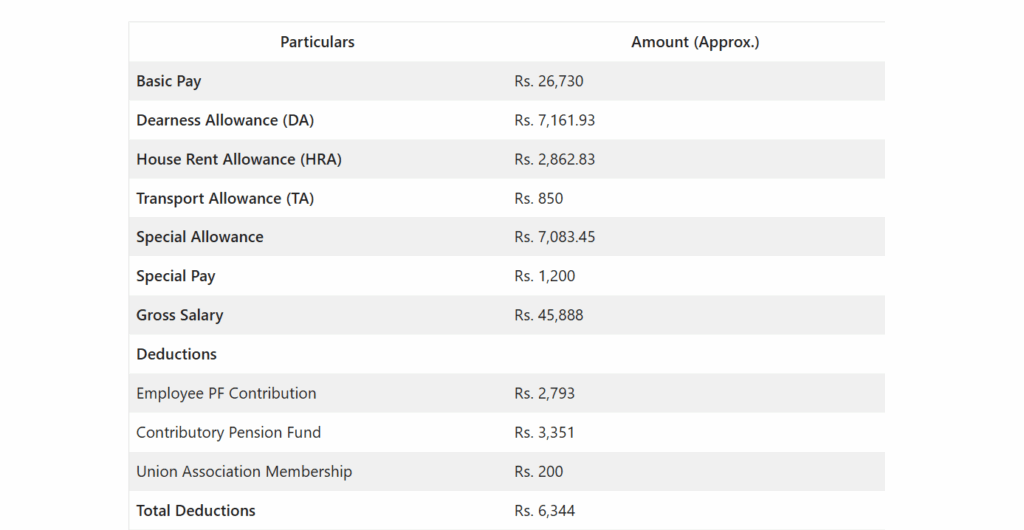

The basic pay of an SBI Clerk starts at Rs. 26,730 which is actually Rs. 24,050 plus two advance increments for graduates and after adding allowances and deducting for some, comes to about Rs. 39,544 in-hand salary for a clerical cadre employee working in a metro city like Mumbai.

| Dearness Allowance (DA) – Rs. 7,161.93 (varies with inflation) |

| Basic Pay – Rs. 26,730; |

| House Rent Allowance (HRA) – Rs. 2,862.83 (depends on posting location) |

| Transport Allowance (TA) – Rs. 850 |

| Special Allowance – Rs. 7,083.45; Special Pay: Rs. 1,200. |

The gross salary would be about Rs.45,888 from which deductions are to be removed as per normal rules for Provident Fund, Pension Fund Union Membership amounting to approximately Rs.6,344 making the net in hand salary as payable at Rs.39,544.

SBI Clerk Salary Structure 2025 The SBI Clerk salary structure defines the pay scale as well as incremental growth with respect to time. For 2025, it is: Rs. 24,050 – 1,340/3 – 28,070 – 1,650/3 – 33,020 – 2,000/4 – 41,020 – 2,340/7 – 57,400 – 4,400/1 -61,800-2 ,680/1-64 ,480 This means that the

Basic pay increments at defined time gaps (like Rs. 1,340 for three years, Rs. 1,650 for the next three and so on). Maximum basic pay comes to Rs. 64,480 after completion of the scale. These increments make provision for steady growth in salary thereby making the job financially attractive with passage of time.

SBI Clerk Salary Slip 2025

The SBI Clerk salary slip shall provide a detailed breakup of earnings and deductions. Here is a sample salary slip for 2025:

| Particulars | Amount (Approx.) |

|---|---|

| Basic Pay | Rs. 26,730 |

| Dearness Allowance (DA) | Rs. 7,161.93 |

| House Rent Allowance (HRA) | Rs. 2,862.83 |

| Transport Allowance (TA) | Rs. 850 |

| Special Allowance | Rs. 7,083.45 |

| Special Pay | Rs. 1,200 |

| Gross Salary | Rs. 45,888 |

| Deductions | |

| Employee PF Contribution | Rs. 2,793 |

| Contributory Pension Fund | Rs. 3,351 |

| Union Association Membership | Rs. 200 |

| Total Deductions | Rs. 6,344 |

| Net In-Hand Salary | Rs. 39,544 |

The pay slip reflects the different allowances added that amount to a very handsome total compensation. Candidates may download the latest version of the SBI Clerk Salary Slip 2025 PDF for reference.

SBI Clerk Perks and Allowances

Other than basic pay, clerks at SBI also enjoy several perks and allowances that differ with posting place and policies of banks such as below:

| House Rent Allowance (HRA): varies by city of posting. |

| Dearness Allowance (DA): paid as per rates of inflation. |

| Transport Allowance (TA): to cover commuting expenditure. |

| Special Allowance: extra compensation for performing clerical functions. |

| Medical Allowance: includes healthcare expenditure. |

| Newspaper allowance: for professional growth. |

| Furniture allowance: for setting up accommodation. |

| Pension (New Pension Scheme): defined contribution benefit. |

| Leave Fare Concession (LFC): for travel during leave. |

| Provident Fund (PF): for retirement saving. |

Telephone Bill Reimbursement, work-related communication Other Facilities, as per bank guidelines.

These allowances render the pay packet of an SBI Clerk quite handsome when set against other clerical posts in the banking line.

SBI Clerk Earnings After 5 Years

The SBI Clerk earnings after 5 years shall comprise the incremental structure, thereby resulting in a considerable amount of total earnings. In line with the salary structure for the year 2025:

- Basic Pay After 5 Years: Rs. 35,020

- Gross Salary After 5 Years: Approx. Rs. 60,119

- In-Hand Salary After 5 Years: Approx. Rs. 51,808

The incremented basic pay alongside proportional increases in all allowances leads to a substantial net take-home or in-hand salary, thus making this position attractive for those who want to build their careers over the long run.

SBI Clerk Training Period and Salary

The training period of an SBI Clerk is six months during probation.

Training Activities: Candidates shall be required to complete e-lessons as may be assigned by the bank on banking operations and customer service.

Performance Evaluation: There will be regular assessments of progress. In case of failure to attain the standards, the probation period may be extended.

Training Period Salary: The entire basic pay amounting to Rs. 26,730 (plus allowances) shall be paid during the training period.

SBI Clerk Job Profile

The SBI Clerk holds a job profile with varied duties, wherein it may require front-office abilities as well as back-office skills. Following are some of the major roles and responsibilities:

1. Junior Associate (Customer Support & Sales)

- Perform marketing and customer outreach activities. This shall include calling as well as providing any type of service.

- Cross-selling bank’s products such as loans, and insurance among others.

- Carry out clerical duties, filing, faxing, and helping branch managers.

- Conduct transactions like opening accounts NEFT/RTGS demand draft and cheque book requisitions.

- Guide customers with their papers.

2. Single Window Operator (SWO)

- Take in inward mail and instruments such as cheques, drafts, and dividend warrants.

- Give cash receipts and some pre-signed financial instruments (like pay orders gift cheques etc.).

- Check clearing and transfer cheques and pass them.

3. Head Cashier (HC)

- Hold the bank’s cash-and-valuables in joint custody with an officer.

- Signature and endorsement of negotiable instruments.

- Involved in dealing with government treasury operations and cheque clearing.

4.Special Assistant (SA)

- To see the work of clerical and sub staff.

- Can process cheques and vouchers independently.

- Reply to queries of customers and also involved in the selling of bank’s products.

5. Universal Teller (UT)

- Check and handle cheques, demand drafts, and withdrawal forms.

- Update passbooks give remittance instruments issue them.

- Answer customers’ questions about the bank’s services.

6. Agricultural Assistant

- Help make agricultural loans and financial help to small-scale businesses happen.

- Check farm plans machinery and livestock from time to time.

- Work with land record offices and developmental agencies.

SBI Clerk Working Hours and Work Pressure

Work at the SBI Clerk typically begins at 10 in the morning and goes on till 5 in the evening, though this may differ from one branch to another and depending upon their workload. Extra hours comprise peak periods plus special demands of a particular branch. Work pressure will depend on the factors that include the location of a branch and flow of customers besides targets for cross-selling products. Any candidate having passion towards understanding responsibilities associated with this job can undertake it willingly without much stress.

Trainee Officer: After three years of service, with JAIIB/CAIIB qualifications, written test and interview. The probation period is for two years. Then they can join Middle Management Grade (Scale 2) or go back to the clerical cadre.

Scale 1 Officer: Can be attained after 6 years (through fast track) or 12 years (in normal track).

Regular promotions and small pay raises make working as an SBI Clerk a solid choice for a long-term career. IBPS SO Prelims Exam Analysis 2025 – 30th August Read More.

SBI Clerk Career Growth

Trainee Officer: After three years of service, with JAIIB/CAIIB qualifications, written test and interview. The probation period is for two years. Then they can join Middle Management Grade (Scale 2) or go back to the clerical cadre.

Scale 1 Officer: Can be attained after 6 years (through fast track) or 12 years (in normal track).

Regular promotions and small pay raises make working as an SBI Clerk a solid choice for a long-term career.The SBI Clerk career path gives great chances for moving up through in-cadre promotions and officer cadre promotions.

- Senior Assistant- On completion of 10 years of service with a special allowance of Rs.1,800.

- Special Assistant- On completion of 20 years with a special allowance of Rs.2,500.

- Senior Special Assistant- On completion of 30 years with a special allowance of Rs.3,500.